Building a Robust Financial Data Warehouse: A Comprehensive Guide

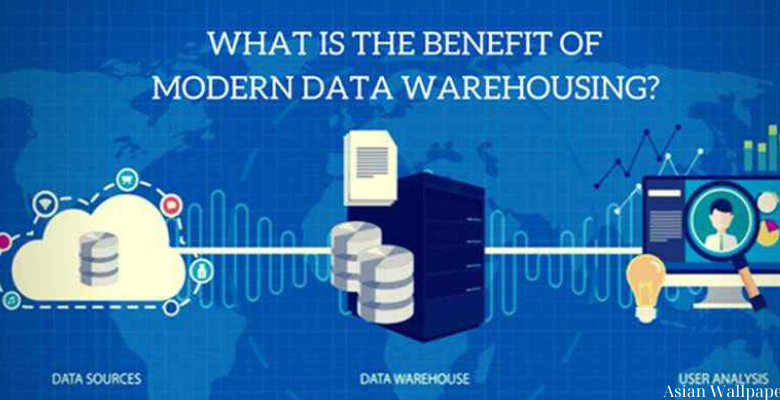

In today’s data-driven financial landscape, businesses are constantly seeking ways to optimize their operations, make informed decisions, and stay ahead of the competition. A key component of achieving these goals is the implementation of a robust financial data warehouse. A financial data warehouse serves as a centralized repository for storing, organizing, and analyzing vast amounts of financial data, providing insights that drive strategic business decisions. In this article, we delve into the intricacies of building a financial data warehouse, covering its importance, key components, best practices, and implementation strategies.

Importance of a Financial Data Warehouse

A financial data warehouse plays a pivotal role in enabling organizations to harness the power of their financial data effectively. Here are some key reasons why it is essential:

- Data Centralization: By consolidating financial data from disparate sources into a single repository, a data warehouse eliminates data silos and provides a unified view of the organization’s financial performance.

- Data Integrity and Consistency: A well-designed data warehouse ensures data integrity and consistency by employing standardized processes for data extraction, transformation, and loading (ETL). This ensures that decision-makers have access to accurate and reliable financial information.

- Enhanced Reporting and Analysis: With a comprehensive data warehouse in place, organizations can generate detailed financial reports and perform in-depth analysis to gain valuable insights into their financial health, performance trends, and key metrics.

- Support for Decision Making: Timely access to relevant financial data empowers decision-makers to make informed strategic decisions, optimize resource allocation, identify areas for cost savings, and capitalize on growth opportunities.

- Regulatory Compliance: In heavily regulated industries such as finance, compliance with regulatory requirements is paramount. A financial data warehouse facilitates compliance by ensuring that relevant financial data is readily accessible for audits and regulatory reporting.

Key Components of a Financial Data Warehouse

Building a successful financial data warehouse requires careful consideration of its key components:

- Data Sources: Identify the sources of financial data within your organization, which may include transactional systems (e.g., ERP, CRM), spreadsheets, external data feeds, and more.

- ETL Processes: Develop robust Extract, Transform, and Load (ETL) processes to extract data from source systems, transform it into a consistent format, and load it into the data warehouse. This step is critical for ensuring data quality and consistency.

- Data Modeling: Design an appropriate data model that reflects the organization’s financial structure and reporting requirements. This may involve dimensional modeling techniques such as star schemas or snowflake schemas.

- Storage Architecture: Choose a suitable storage architecture for your data warehouse, considering factors such as scalability, performance, and cost. Options range from traditional relational databases to cloud-based data warehouses.

- Metadata Management: Implement robust metadata management practices to document and track the lineage, definitions, and usage of financial data within the warehouse. This enhances data governance and facilitates collaboration among stakeholders.

- Security and Access Control: Implement stringent security measures to protect sensitive financial data from unauthorized access, ensuring compliance with data privacy regulations such as GDPR and CCPA.

- Query and Analysis Tools: Select appropriate tools for querying, analyzing, and visualizing financial data stored in the warehouse. Popular options include SQL-based querying tools, business intelligence platforms, and data visualization tools.

Best Practices for Building a Financial Data Warehouse

To ensure the success of your financial data warehouse initiative, consider the following best practices:

- Define Clear Objectives: Clearly define the objectives and scope of your data warehouse project, aligning them with the organization’s strategic goals and business requirements.

- Engage Stakeholders: Involve key stakeholders from finance, IT, and business units early in the planning and design phases to gather requirements, validate assumptions, and ensure alignment with business needs.

- Start Small, Scale Gradually: Adopt an iterative approach to data warehouse development, starting with a small pilot project or proof of concept and gradually scaling up based on feedback and lessons learned.

- Focus on Data Quality: Prioritize data quality throughout the data lifecycle, from extraction to reporting. Implement data validation checks, cleansing routines, and error handling mechanisms to maintain data integrity.

- Ensure Scalability and Flexibility: Design the data warehouse architecture with scalability and flexibility in mind to accommodate future growth, evolving business requirements, and technological advancements.

- Promote Data Governance: Establish data governance policies, processes, and controls to ensure that financial data is managed effectively, compliant with regulations, and aligned with business rules and standards.

- Provide Training and Support: Invest in training programs to empower users with the knowledge and skills needed to leverage the data warehouse effectively. Provide ongoing support and documentation to address user queries and challenges.

Conclusion

In conclusion, a financial data warehouse is a cornerstone of modern financial management, enabling organizations to unlock the full potential of their financial data. By centralizing data, ensuring integrity, and providing powerful analytical capabilities, a data warehouse empowers decision-makers to drive strategic initiatives, mitigate risks, and achieve sustainable growth. By following best practices and adopting proven implementation strategies, organizations can build a financial data warehouse that serves as a valuable asset in today’s competitive business landscape.

Conclusion: So above is the Building a Robust Financial Data Warehouse: A Comprehensive Guide article. Hopefully with this article you can help you in life, always follow and read our good articles on the website: Asian Wallpaper